From 5 Sep – 30 Sep, Learn How to Trade the SG/HK/US Indices From an Exciting Line Up of Speakers & Participate in the Index Performance Polling Activity With Up to S$5,000 Worth of Prizes Up for Grabs!

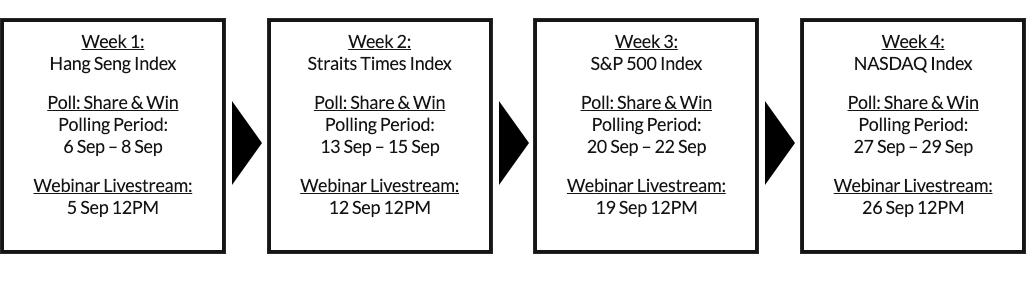

This 4-week Index Trading Rally consists of 2 categories:

Polls + Webinars

**Check out the Official Winners’ Announcement here.**

Participate in our Polls & share your insights on how each index will perform for across 3 days per week, stand to win up to grand prizes worth up to S$4,000 over 4 weeks!

(5x Winners)

(5x Winners)

Attend webinars and share your insights to win $200 vouchers! (5x Winners)

Attend webinars and share your insights to win $200 vouchers! (5x Winners)

Poll, Share & Win Up To $4,000 Worth of Prizes!

Grand prizes:

1x Samsung Galaxy Fold 4 (worth $2,400)

1x Nintendo Switch OLED Model (worth $400)

1x Delonghi Premium Coffee Machine (worth $500)

1x Sony Noise-Cancelling Headphones WH1000XM4 (worth $400)

1x Samsonite Premium Niar Luggage (worth $400)

Week 4 Finale: How Will The NASDAQ-100 Perform?

Week 4 Finale: How Will The NASDAQ-100 Perform?

26 Sep

Will NASDAQ-100 Close Higher Or Lower Tomorrow on 27 Sep?

[27 Sep 9.30PM – 28 Sep 4AM Singapore Time (GMT+8)]

27 Sep

Will NASDAQ-100 Close Higher Or Lower Tomorrow on 28 Sep?

[28 Sep 9.30PM – 29 Sep 4AM Singapore Time (GMT+8)]

28 Sep

Will NASDAQ-100 Close Higher Or Lower Tomorrow on 29 Sep?

[29 Sep 9.30PM – 30 Sep 4AM Singapore Time (GMT+8)]

Week 3: How Will The S&P500 Perform?

Week 3: How Will The S&P500 Perform?

19 Sep

Will S&P500 Close Higher Or Lower Tomorrow on 20 Sep?

[20 Sep 9.30PM – 21 Sep 4AM Singapore Time (GMT+8)]

20 Sep

Will S&P500 Close Higher Or Lower Tomorrow on 21 Sep?

[21 Sep 9.30PM – 22 Sep 4AM Singapore Time(GMT+8)]

21 Sep

Will S&P500 Close Higher Or Lower Tomorrow on 22 Sep?

[22 Sep 9.30PM – 23 Sep 4AM Singapore Time(GMT+8)]

Week 2: How Will The STI Perform?

Week 2: How Will The STI Perform?

12 Sep

Will STI Close Higher Or Lower Tomorrow on 13 Sep?

13 Sep

Will STI Close Higher Or Lower Tomorrow on 14 Sep?

14 Sep

Will STI Close Higher Or Lower Tomorrow on 15 Sep?

Week 1: How Will The HSI Perform?

Week 1: How Will The HSI Perform?

5 Sep

Will HSI Close Higher Or Lower Tomorrow on 6 Sep?

6 Sep

Will HSI Close Higher Or Lower Tomorrow On 7 Sep?

7 Sep

Will HSI Close Higher Or Lower Tomorrow on 8 Sep?

How to win?

For each week, there will be a focus index (HSI, STI, S&P 500, NASDAQ) and 3 polling days for participants to vote how each Index will perform the next day.

This campaign will stretch across 4 weeks from 5 Sep to 30 Sep, so there will be a total of 12 days for participants vote.

In order to be eligible* to win grand prizes, you will need to do the following:

- Participate in at least 4 polls from 5 Sep – 30 Sep (complete a total of 4 polls)

- Share your market views by commenting in the Polls you voted for and tag one Societe Generale (SG) DLC which you like!

Participants with the most enlightening comments will be selected to win the prizes!

As long as you vote daily and share your market views on a DLC, you will stand a chance to WIN prizes such as Samsung Galaxy Fold 4, Nintendo Switch, Delonghi Coffee Machine worth up to $5,000 in total!

*Eligibility of winning does not take the outcome of the poll, but the quality of the comments. Selection of winners will be conducted by the InvestingNote team. View T&Cs here.

Stand to WIN simply by voting & sharing your views in the comments!

Stand to WIN simply by voting & sharing your views in the comments!

Catch our Youtube Livestreams & WIN

5x $200 Capitaland Vouchers Up For Grabs!

How to Win?

Watch ALL 4 of the webinar youtube livestreams & Share your learning points for each webinar via the comments under each webinar’s post in InvestingNote and tag one of Societe Generale’s (SG) DLC – the 5 most enlightening posts will be selected to win $200 Capitaland Vouchers!

It’s really that simple!

*no registration is needed as the Livestreams will play automatically on Youtube during the specific date & time.

Week 1: HSI Trading Webinar

Livestream Date:

5 Sep, 12PM

Speaker:

Robin Ho

Professional Day Trader & Top-tier Trading Representative, PhillipCapital

Week 2: STI Trading Webinar

Livestream Date:

12 Sep, 12PM

Speaker:

Dan Chang

Veteran Trading Representative, PhillipCapital

Week 3: S&P500 Trading Webinar

Livestream Date:

19 Sep, 12PM

Speaker:

Lyn Nakamori

Veteran Retail Trader & Educator

Week 4: NASDAQ Trading Webinar

Livestream Date:

29 Sep, 12PM

Speaker:

Binni Ong

Professional Trader & Founder TerraSeeds

Week 1: HSI Trading Webinar By Robin Ho

Monday 5 Sep 12PM

Week 1: HSI Trading Webinar By Robin Ho

Monday 5 Sep 12PM

The DLCs will be open for trading during SGX Securities market trading hours. However the market maker would not quote in the market if the underlying markets of the respective DLCs are closed.

For the purpose of this simulation, we have restricted the trading hours to as follows (similar to when the market maker would quote in the real market):

DLCs on SGX-listed underlyings – 9am to 12pm; 1pm to 5pm

DLCs on HK Indices (HSI/HSCEI) – 9:15am to 12pm; 1pm to 4:30pm

DLCs on HK-listed Stocks – 9:30am to 12pm; 1pm to 4pm

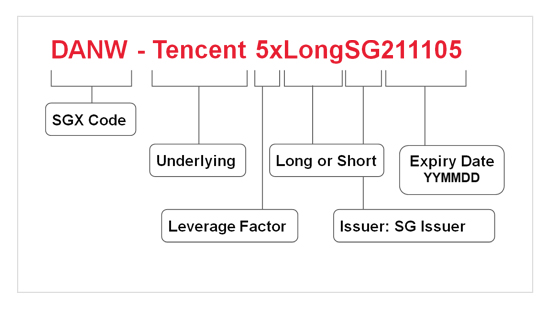

The full name of a DLC already tells a lot of information. Below examples show how to read a DLC name.

If there are more than one DLC with the same terms, DLCs that are launched subsequently are supplemented with an ‘A’, ‘B’, ‘C’ and so forth after expiry date.

What happens if I hold a DLC until expiry?

If you hold a DLC until expiry, the DLC will be settled at the fair value based on the pricing formula. If a 5x DLC is worth S$2 one day before expiry, and if the Underlying Stock remains unchanged on the expiry date, then the settlement price of the DLC will be at S$2.

(for reference: https://dlc.socgen.com/en/education/handbook)

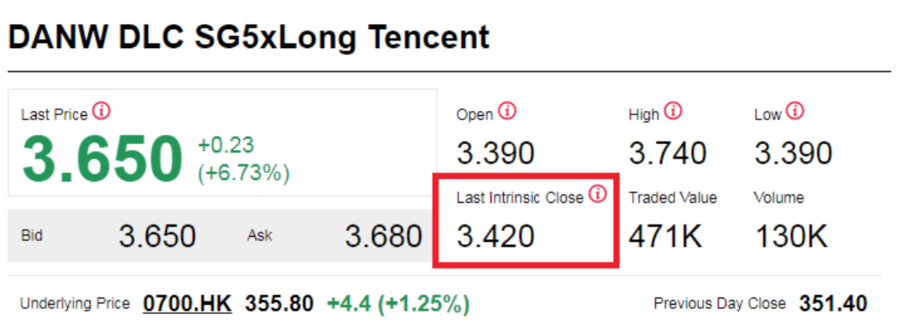

Apart from rounding and bid/ask which also impact the performance shown but to a lesser extent, the most common reason why investors might perceive that the DLC performance has deviated from expected leverage performance is due to a wrong reference price being used.

DLCs are designed around day-on-day performances, i.e. DLC performance should be compared to its value at underlying closing time the previous day. According to SGX’s methodology of calculating daily percentage performance, SGX uses the last traded price of the DLC the previous day as the base (denominator). Since the time of the last trade on the DLC the previous day does not necessarily coincide with that of the underlying, there is a mismatch in what we are comparing. Less popular DLCs (with less trading to “refresh” the last price) usually show a bigger discrepancy.

To check if your DLC is providing the leverage performance as promised, you should compare the current bid price of the DLC against the “intrinsic close” value that is published daily on SG’s website. This “intrinsic close” is the value of the DLC at the underlying closing time the previous day, and serves as an accurate reference price to calculate the expected leverage performance.

Reason to issue more than one DLC

Usually the reason to issue more than one product on the same underlying asset, direction and leverage is because the price sensitivity of existing products are getting lower due to their low unit price. The new products will provide investors with higher-sensitivity options, which is more favorable for short-term trading.

How to differentiate between the existing and new DLCs

For index DLCs, investors can differentiate between the existing and new DLCs by their expiry date as indicated in the counter name and by their stock code. The new products will have a longer dated expiry.

For single stock DLCs, apart from the difference in stock code, a letter (“A”, “B” and so forth) will be added to the new product name for easy identification. For example, the name of the new 5x Short DLC on Tencent is “DLC SG5xShortTencent A”. Investors can also go to SocGen’s website https://dlc.socgen.com to check the difference in expiry date.

What are the differences between an “expensive” and a “cheap” DLC, if everything else (Underlying Asset, Direction and Leverage Factor) is the same?

These “cheap” DLCs might look attractive as investor can buy more shares with the same capital outlay.

In fact, the theoretical percentage movements between high and low priced DLCs are the same. (If a stock goes up by 2%, 5x Long DLC originally at 0.05 will go up to 0.055 while 5x Long DLC originally at 0.5 will go up to 0.55, both up by 10% before costs and fee; If a stock goes down by 2%, 5x Long DLC originally at 0.05 will go down to 0.045 while 5x Long DLC originally at 0.5 will go down to 0.45, both down by 10% before costs and fee)

Moreover, such low-price DLCs have the following disadvantages:

1. Bid ask spread is large on low-price DLCs. Taking a DLC at SGD 0.01 as an example, the minimum possible bid/ask spread is 0.001. For a DLC that is worth 0.01, the minimum bid ask spread is 10%. The lower the DLC price is, the larger the minimum possible spread is.

2. As a result of the big bid ask spread, the DLC will become insensitive to underlying stock/index movement. In a day where the Underlying Asset movement is mild, DLC bid/ask quotes may remain unchanged for the entire trading day due to the insensitivity.

3. As DLC theoretical bid price drops below minimum possible order price (0.001), issuers will not be able to provide both bid and offer.

DLC is not a stock. Investors will not be better off holding more shares. Both high and low-priced DLCs have the same leverage factor and move by the same theoretical movement compared to the Underlying Asset, be it 3, 5 or 7 times, Long or Short. However, investors should take note that there are some disadvantages in trading low-price DLCs.

Because of the above, when faced with DLCs with the same Underlying Asset, Direction and Leverage Factor, investors are advised to choose the higher-value DLC.

What will happen to the existing DLCs

Despite the difference in price, sensitivity and expiry date, investors should note that both the existing and new products will move by the same theoretical percentage movement. For DLCs that are below certain value, DMM will keep the same market making quality on the bid side but may reduce the offer size.

DLC price, no matter Long DLC or Short DLC, is not supposed to be impacted by dividend payout.

Taking DBS stock as an example. Assuming DBS is at S$ 25.5 today at close and tomorrow is ex-dividend day and DBS is paying out S$ 0.5 of dividend. If tomorrow DBS opens at S$ 25, both Long DLC and Short DLC will be unchanged in value (before costs and fees). If DBS opens at S$ 25.5, it will be seen as up by 2%, i.e. 5x Long DLC will be up by 10% and 5x Short DLC will be down by 10% (before costs and fees).

The same concept applies to corporate action, i.e. DLC prices will not be affected by corporate action adjustments.

Investors can refer to “Leverage Strategy Formula” and “Examples and illustrations of adjustments due to certain corporate actions” in the relevant Supplemental Listing Document of the DLCs for more details.

For more information, please visit https://dlc.socgen.com or https://sgx.com/dlc. Alternatively, you may email to dlc@socgen.com if you have any questions on the DLC.

The issue price of a DLC is arbitrary, i.e. it is decided by the issuer, which is similar to the mechanism of a stock or an ETF. For DLC, issuers determine the issue price that strikes a balance between tighter spread and higher sensitivity.

Because DLC issue price is arbitrary, for two DLCs of the same underlying asset, direction and leverage but of different prices, the lower-priced DLC should not be considered as more cost-effective than the higher-priced one. In fact, the higher-priced DLC will be more sensitive than the lower-priced DLC and hence will be a better product from short-term trading perspective.

After a DLC is launched, its fair value is calculated according to the pricing formula, i.e. (daily percentage performance of the underlying asset x leverage) minus costs and fees applicable. Investors can check the latest intrinsic closing values on https://dlc.socgen.com, or can refer to the relevant Supplemental Listing Document published on the same website or SGX’s website.

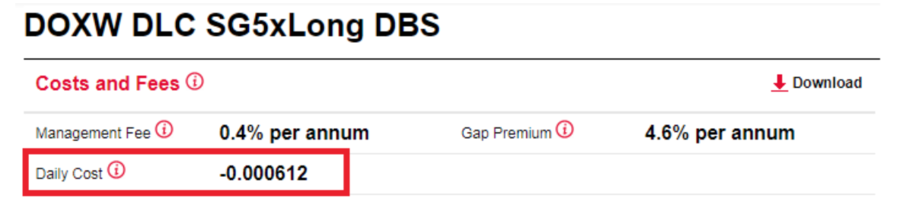

Investors holding their positions overnight will incur leverage and hedging costs and fees which consist of the Management Fee, Funding Costs, Stock Borrowing Costs (for Short Certificates only), Rebalancing Costs (if applicable) and Gap Premium, which are calculated daily and applied to the value of the product (i.e. reflected in the bid/ask quotes and not a separate transaction). The costs and fees level will be published on the website at https://dlc.socgen.com and updated daily.

Usually, the daily cost & fee is accumulated is less than a minimum tick.

For the full calculation of the cost and fees, investors can refer to the “Leverage Strategy Formula” section in the relevant Supplemental Listing Documents of the DLCs.

Expiry Date of a DLC is usually 3 years from its launch date.

Last Trading Date usually falls on the date which is 5 business days before Expiry Date. Investors will not be able to trade the DLCs after Last Trading Date.

DLCs will be delisted after Expiry Date. If investors hold certain DLC until expiry, the DLC will be cash settled at its fair intrinsic value determined on Valuation Date, which is usually one Business Day before Expiry Date.

The cash settlement will be made no later than 5 Business Days after Expiry Date. Societe Generale does not charge any expiry processing fee. Investors may refer to the Termsheet and Supplementary Listing Document of the DLCs for the exact dates.

Prior to expiry of a DLC, issuers may issue DLCs with a longer expiry for investors to continue expressing the same view.

Example

Assuming for a certain DLC

Last Trading Date = 6 July

Valuation Date = 13 July

Expiry Date = 14 July

Settlement Date no later than 21 July

Intrinsic Close on 6 July = SGD 0.2

Intrinsic Close on 13 July = SGD 0.25

Investors will not be able to trade the DLC after 6 July (Last Trading Date), and the value of this DLC will keep moving with the Underlying Asset according to the formula until 13 July (Valuation Date). In other words, investors who do not sell the DLCs on or before Last Trading Date will bear the market risk from Last Trading Date to Valuation Date. The DLC will cease to exist after 14 July (Expiry Date), and the cash settlement (if any) will be made no later than 21 July (last Settlement Date). In this example, investors will get back SGD 0.25 per unit of DLC (being intrinsic value determined on Valuation Date).

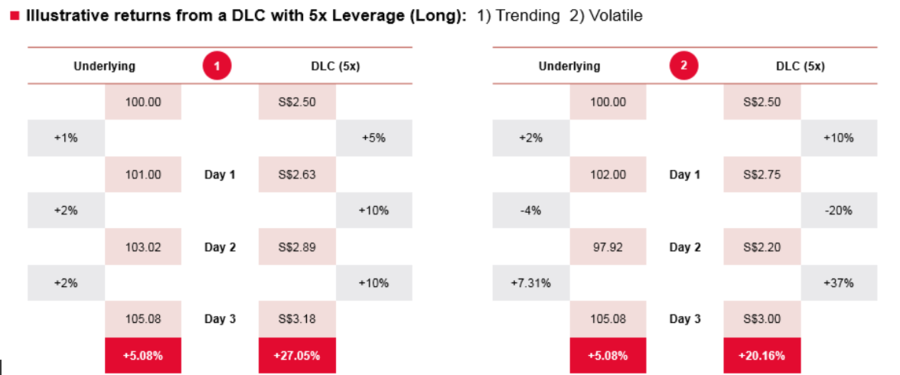

This is likely due to compounding effect.

DLC’s leverage is fixed on a daily basis and is reset (back to the fixed leverage) at the end of each trading day. Technically, if a DLC is held for longer than a day, the return will be compounded every day, i.e. overall cumulative return would deviate from underlying asset cumulative performance multiplying by the fixed leverage. This is called compounding effect.

Compounding effect can be positive or negative, depending on the “path” of the underlying asset during the trading period.

From the example above, the same overall cumulative performance of the underlying can result in a varying performance in the 5x DLC. In scenarios 1 and 2, the underlying reaches the same level of 105.08 after three days – however, on different “paths”. The DLC performs differently in each scenario. In scenario 1, the underlying is on a clear upward trend, whereas in scenario 2 it is in a very volatile movement. In this case, the Daily Leverage Certificate performs better in scenario 1 than in scenario 2.

In general, compounding effect tends to be positive in trending market. For a Long DLC, when the market is trending up, Long DLC could deliver return more than the fixed leverage; when the market is trending down, Long DLC could lose value less than the fixed leverage.

In side-way or volatile market, DLCs may deliver leverage less than the fixed leverage, or may arrive at a loss when the underlying asset goes back to the same price after a volatile period.

The nature of compounding effect to a certain extent positions DLC as a trend trading product.

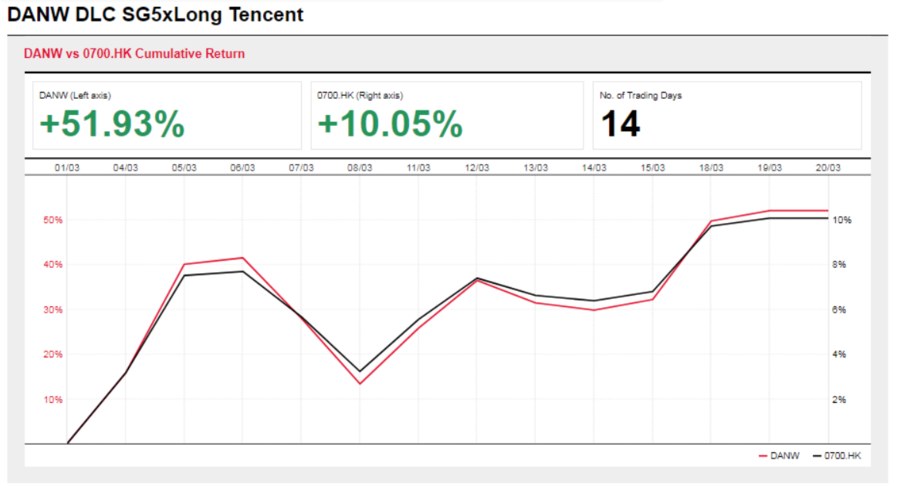

The “Cumulative Return” tool on https://dlc.socgen.com can help investors better understand compounding effect by selecting a historical period and compare the cumulative returns between underlying asset and DLC:

Investors can also refer to the section of “Illustration on how returns and losses can occur under different scenarios” in the relevant Supplemental Listing Document of the DLC for more information about compounding effect.

(for reference: https://dlc.socgen.com/en/education/handbook)

CERTIFICATES (DLC)